There are many misconceptions about ELSS mutual funds. These misconceptions often result in people misunderstanding or not being able to take full advantage of ELSS mutual funds.

5 Things You Must Know About ELSS Tax Saver Mutual Funds

#1 ELSS Lock in Period

ELSS funds have a lock in period of 3 years from the date of investment.

Lump Sum Example: If you invest ₹1 lakh in May 2019, you will be able to redeem your investment after 3 years in May 2022.

#2 Year of Tax Savings

The investment made will give you tax benefits only for the current financial year. The max benefit you can get under Section 80C is ₹1. 5 lakh per year. You may make investments of more than this amount in an ELSS mutual fund. However, you won’t get any tax benefit on the amount invested which is above ₹1.5 lakh.

Lump Sum Example: If you invest ₹1. 5 lakh in the financial year 2018-2019, you will get tax benefits in the financial year 2018-2019. Investing more than that amount in 2018-2019 will not give you any benefits in the next financial year.

SIP Example: You will get tax benefits on the total amount of SIP made in the current year only. To get the maximum tax benefit, your total SIP in the current financial year should be ₹1. 5 lakh. You won’t get any additional benefits if you exceed this amount. If you invest ₹15000 per month for one financial year, you total investment in the financial year would be ₹1.8 lakh. But you will get tax benefit of only worth ₹1.5 lakh.

#3 Total Benefits

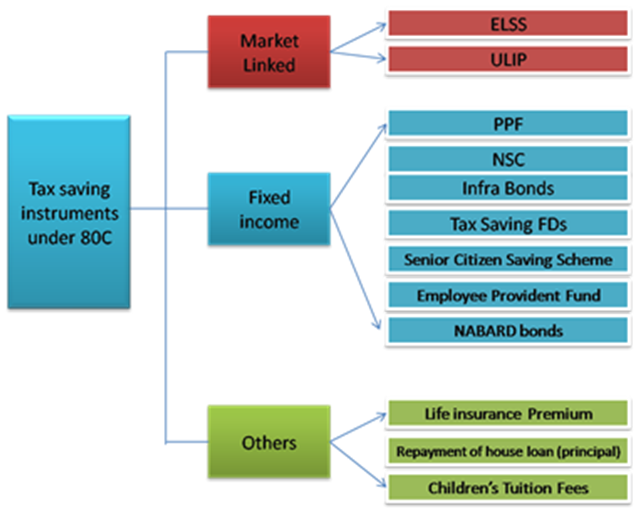

The ₹1. 5 lakh tax exemption under 80C is not just for ELSS tax saving mutual funds. It includes many other exemptions. Some of those are PPF, Life Insurance Scheme, Home Loan Principal Repayment, Children’s Education Fee, etc. You can only claim benefits on a total of ₹1. 5 lakh under Section 80C.

Example: If you pay a total of ₹1 lakh on your children’s education, you can only take ₹50000 worth of benefit from ELSS mutual funds.

#4 Tax on Earnings From ELSS Tax Saver Mutual Funds

ELSS mutual funds are equity mutual funds. Equity mutual funds don’t have any tax levied on them for redemption after 1 year. ELSS funds are locked in for 3 years. Therefore, the capital gains on them are tax exempt. So you have to pay no tax. So ELSS mutual funds not only help you save tax, they can also generate non-taxable gains for you.

#5 You Do Not Have to Redeem After the Lock in Period Ends

If you feel your investment in an ELSS mutual fund is doing well, you can choose to remain invested in the mutual fund even after the 3-year lock in period. It is not compulsory to redeem the amount. The mutual funds will then be treated as a regular equity mutual fund.

Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing.

| Deductions under Chapter VI (sec 80C) | Deductions under Chapter VI (sec 80C) |

| Deduction under Pension scheme (sec 80C). | Medical Insurance Premium (sec 80D). |

| NSC (sec 80C). | Medical for handicapped dependents (Sec 80DD). |

| Public Provident Fund (sec 80C). | Medical for specified diseases (Sec 80DDB). |

| Employees Provident Fund & Voluntary PF (sec 80C). | Higher Education Loan Interest Repayment (Sec 80E). |

| Children’s Education (sec 80C). | Donation to approved fund and charities (sec 80G). |

| Housing loan principal repayment (sec 80C). | Rent deduction (sec 80GG) only if HRA not received. |

| Insurance premium (sec 80C). | Deduction for permanent disability (80U). |

| Infrastructure Bonds & others (MF, ULIP, etc.) (sec 80C). |