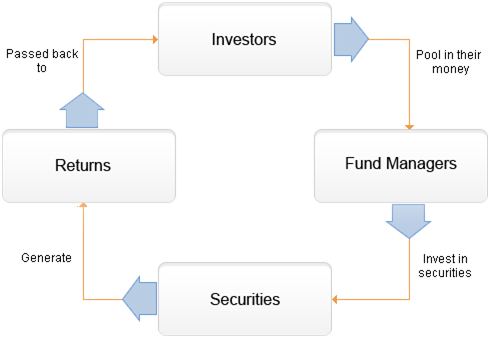

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual funds. Each share represents an investor’s part ownership in the fund and the income it generates.

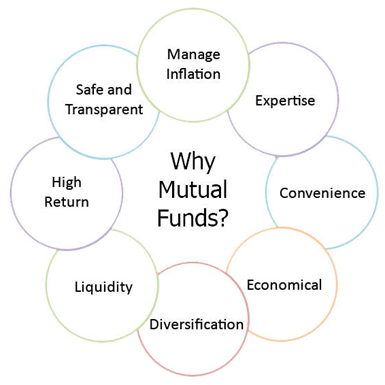

Why Mutual Funds

Liquidity: You can buy and sell most mutual funds on any business day. This is unlike bank fixed deposits, PPF or Insurance Policies.

Diversification: A mutual fund gives you exposure to a basket of stocks and bonds at a very low cost. If you had to buy them directly, you would need to invest a much larger sum of money.

Low Cost: Mutual fund expense ratios are typically 1.5-2.5% of your investment. This amount pays for fund administration, fund manager fees and much else. This is possible because these costs are spread between hundreds of different investors.

Transparency: Mutual funds are tightly regulated by the Securities and Exchange Board of India (SEBI) and their NAV (Net Asset Value) is disclosed on a daily basis. Their portfolios are also disclosed each month and various other details about are available in the public domain.

What you need to get started with Mutual Fund

investing?

To start investing in a fund scheme you need a PAN, bank account and be KYC

(know your client) compliant. The bank account should be in the name of the

investor with the Magnetic Ink Character Recognition (MICR) and Indian

Financial System Code (IFSC) details. These details are mentioned on every

cheque leaf and it is common for an agent or distributor to seek a cancelled

bank cheque leaf.

How to get your KYC?

The need for KYC is to comply with the market regulator SEBI in accordance with

the Prevention of Money laundering Act, 2002 (‘PMLA’), which undergo changes

from time to time.

Documents required to be submitted along with KYC application

- Recent passport size photograph

- Proof of identity such as a copy of PAN card or UID (Aadhaar) or passport or voter ID or driving licence

- Proof of address passport or driving license or ration card or registered lease/sale agreement of residence or latest bank A/C statement or passbook or latest telephone bill (only landline) or latest electricity bill or latest gas bill, which are not older than three months.

You will need to submit copies of all these documents by self-attesting them along with originals for verification. In case the original of any document is not produced for verification, then the copies should be properly attested by entities authorised for attesting the documents. In case you are unable to furnish proper documents, it could result in delays in getting a KYC.

For more Information, kindly do contact us :